Great New Benefits:

|

|

|

|

If you have any questions regarding your new Debit Card, or if you need to update your address, please contact our Member Resource Center at 1-800-342-8298.

What is EMV Chip Technology?

{beginAccordion}

How do I use my chip card at an ATM?

- Insert the chip end of your card, with the chip facing up, into the chip-enabled ATM.

- Leave your card in the ATM slot for the entire transaction. Follow the prompts on the screen to complete the transaction.

- Remove your card when prompted and take the receipt. A light located directly above the card reader will flash to prompt you to retrieve your card. If you do not take your card after a few seconds, the ATM will beep to remind you to remove your card.

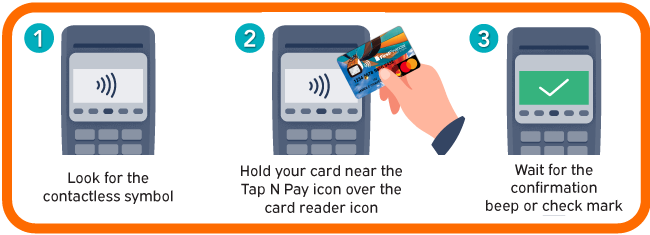

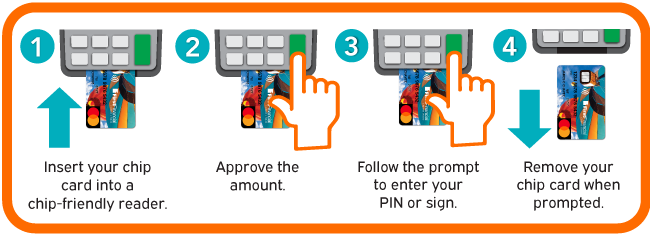

How do I use my chip card in stores?

When you try to swipe the commonly used magstripe at a merchant’s chip-enabled POS terminal, you will be prompted by the terminal to use your card’s chip instead. When instructed to do so, follow these general steps:

- Instead of swiping your card, insert the chip end of your card—with the chip facing up—into the chip-enabled terminal.

- Leave your card in the terminal throughout the entire transaction and follow the prompts on the screen to complete the purchase.

- Remove your card when prompted and take your receipt.

{endAccordion}

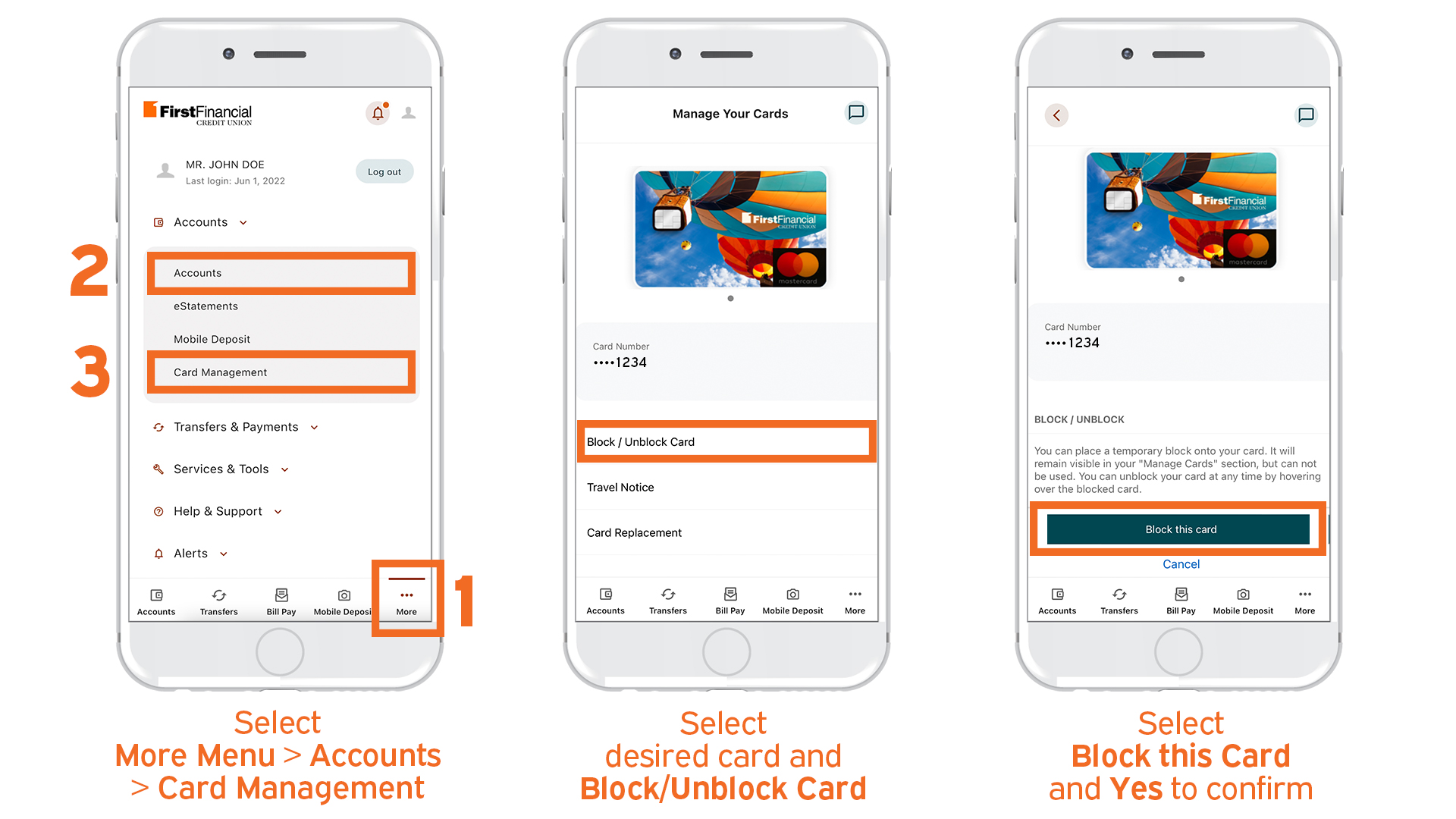

New and Improved Debit Card Controls!

Technology that enables superior control, security, and financial visibility via mobile and online banking. It lets you manage your cards on-the-go!! You control when and where your cards can be used, as well as view and act on instant alerts when transactions are processed. Learn More.

With Debit Card Controls, you can:

{beginAccordion}

Turn your card on/off

Control your debit card 24/7 and instantly disable your debit card(s) to prevent transactions. When your card is turned ON, you can use it for normal transactions. When your card is turned OFF, one-time transactions using your card or card number will be declined. Recurring transactions will still process when your card is turned OFF.

Set Travel Notices

Notify us right in your app when you plan to travel to prevent your card from being turned off/declined.

Order Replacement Cards

Do you think your debit card was lost or stolen? Not only can you turn off your card, but you can also order replacement debit cards right from your phone anytime day or night.

{endAccordion}