What are FFCU Debit Card Controls?

Technology that enables superior control, security, and financial visibility via mobile and online banking. It lets you manage your cards on-the-go!! You control when and where your cards can be used, as well as view and act on instant alerts when transactions are processed.

{beginAccordion}

What are the Benefits?

- Manage where, when, and how your cards are used.

- Turn cards on and off instantly from your mobile device.

- Limit spending amounts to reach budget goals.

- Restrict types of purchases made.

|

TYPE |

ALERT PREFERENCES |

CONTROL PREFERENCES |

|

Location – Based on where the transaction occurs (merchant location). |

|

|

|

Transaction Limits - Based on the threshold amount set by the user. |

|

|

|

Transaction Type – Based on the type of transaction at point of sale. |

Any of the following types may be turned on to send an alert when a transaction of that type occurs:

|

Any of the following types may be turned on to deny transactions of that type:

|

|

On/Off – Turn your card on/off. |

|

Only allow transactions when you turn your card on:

|

|

Alerts for all transactions. |

Receive an alert every time your card is used. (Cannot be used in conjunction with any other alerts). |

|

{endAccordion}

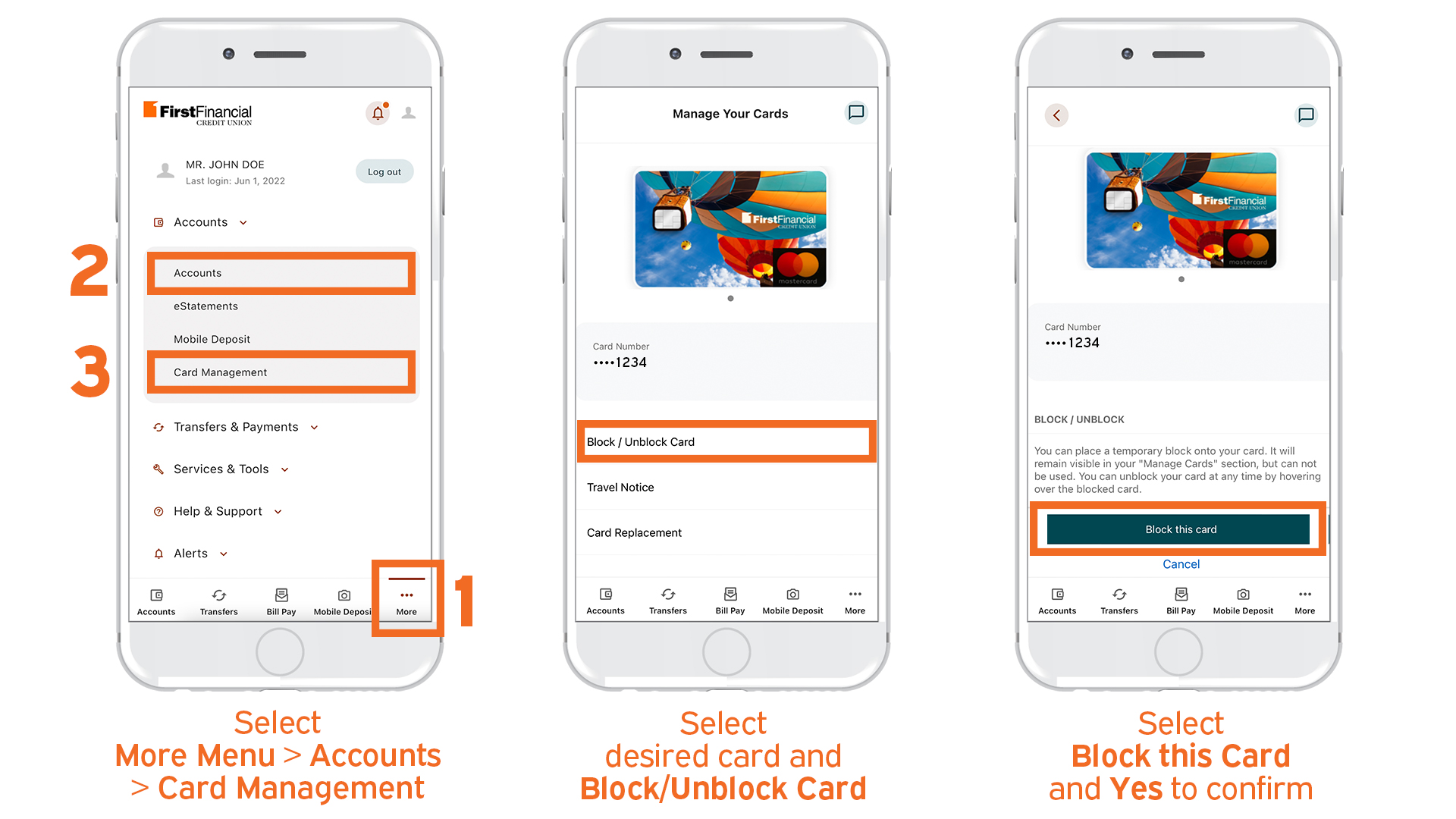

Debit Card Control Your Cards from Your Phone

Card Control is a feature in our mobile banking app that makes controlling your FFCU debit card as easy as picking up your smartphone. With Card Control, you can:

{beginAccordion}

Turn your card on/off

Control your debit card 24/7 and instantly disable your debit card(s) to prevent transactions. When your card is turned ON, you can use it for normal transactions. When your card is turned OFF, one-time transactions using your card or card number will be declined. Recurring transactions will still process when your card is turned OFF.

Set Travel Notices

Notify us right in your app when you plan to travel to prevent your card from being turned off/declined.

Order Replacement Cards

Do you think your debit card was lost or stolen? Not only can you turn off your card, but you can also order replacement debit cards right from your phone anytime day or night.

{endAccordion}

Q&A

{beginAccordion}

Can First Financial Card Controls be controlled from a desktop or laptop computer?

Yes, First Financial Card Controls can be controlled via online banking and mobile banking on any devices that can access the internet.

Whom do I contact to get started or for support?

Please contact us directly with any support questions.

Will First Financial Card Controls work outside the U.S.?

Yes. If your phone has an internet connection, First Financial Card Controls will work.

How long can I leave a card “off”?

You can turn your cards off, leave them off as long as you want to, and only turn them back on when you want to perform transactions. Note: Debit cards may be turned off after 6 months of inactivity.

Are notifications via push, or do you have to be logged in?

Notifications are push notifications via the app. You do not need to be logged in. You can also receive notifications via email.

What if I have my card turned off and a recurring utility bill wants to charge my card? Will that transaction be denied?

When the card is off, most card transactions are denied, including auto-pay transactions and credits (deposits, returns, and reversals).

{endAccordion}