You Get Your Assistant. We'll Get You The Funding.

Key Features

-

Competitive Rates

Competitive Rates

-

Quick Decisions

Quick Decisions

-

Local Processing

Local Processing

Access the equity in your home and use the funds for home improvements, college tuition, debt consolidation or whatever you need!

First Financial Home Equity Line Loans Offer:

- Competitive rates for short-term or one-time needs:

- Major life events

- Home remodel projects

- Debt consolidation

- And more!

- The existing equity in your home is used as collateral

- Flexible Lines of Credit available means the money is there when it is needed most

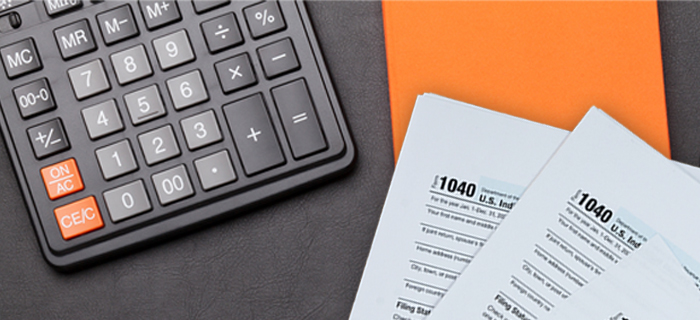

- The interest paid might be tax deductible1

- Local decision-making and processing

- Dedicated, friendly service from start to finish

*Income and credit qualifications apply. Rates are subject to change, please inquire for current rate. Subject property must be the member’s primary residence. Manufactured or mobile homes do not qualify for this offer. Homeowner’s insurance will be required as well as flood insurance if applicable. Interest rate is variable, based on the Wall Street Journal Prime Rate, plus a margin. Margin offered is dependent on the member’s strong credit characteristics. Members with less than strong credit characteristics may be offered a higher margin.

1Consult a tax advisor.